Technical Chart pick of the day: EURUSD – Turning Bearish

The EUR started the descent ahead of the PMI data release which investors started pricing in during the European open. Figures have improved significantly but are still far from the 50.0 key level as many EU countries are now expected to fall into recession in the second quarter.

In the US, tensions are escalating further with China with President Trump accusing China of an attack of disinformation and propaganda in the United States and Europe which “comes from the top”.

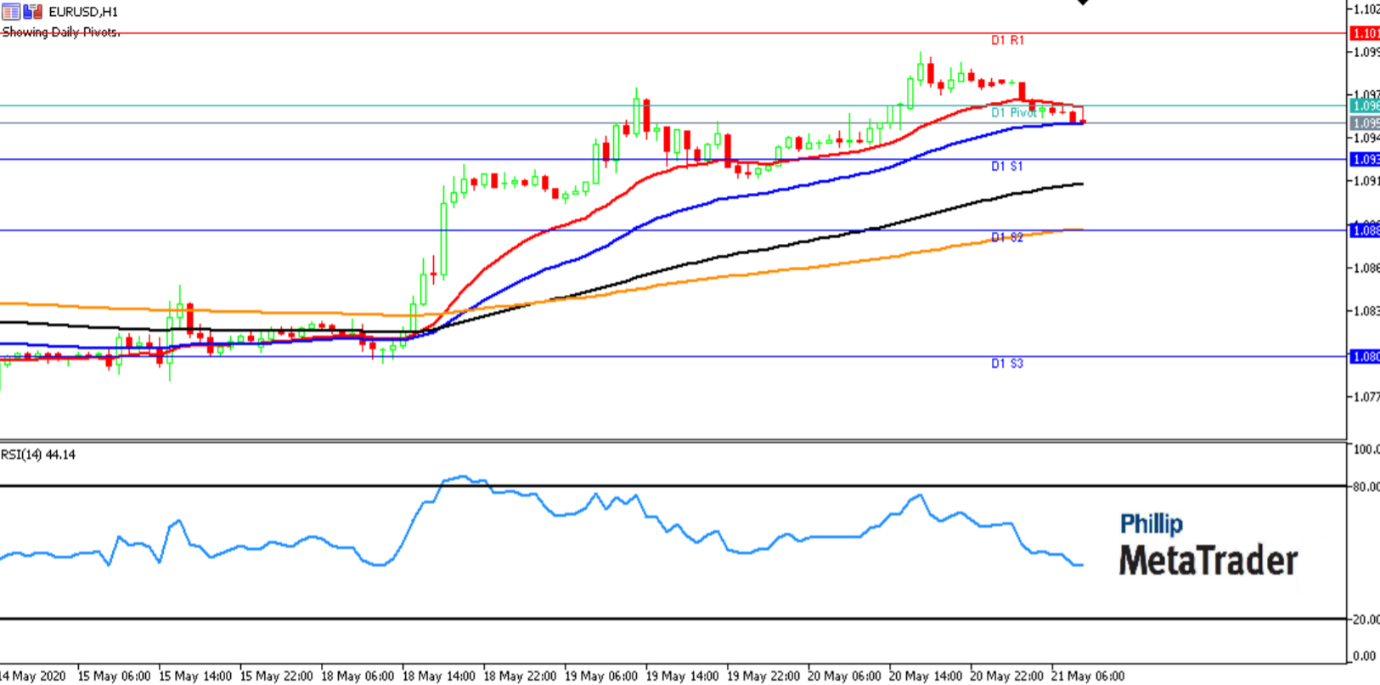

· On a technical perspective, the trend is turning bearish, with prices above the 20 EMAs

· The trend lines have started to flatten and show signs of converging. This indicates that Selling pressure is present.

· Based on the pivot point analysis, prices are below the pivot levels. This signifies bearishness.

Resistance: R1: 1.10107, R2: 1.10448, R3: 1.11250

Support: S1: 1.09305, S2: 1.08844, S3: 1.08042