Technical Chart pick of the day: AUDUSD – Bullish

The USD slumped against a basket of currencies as the prospects of most nations reopening, bolstered hopes of a global economic recovery. In addition, markets too appear to be weighing the unrest in the US, where large-scale riots are taking place despite the Covid-19 situation. Eyes will now be towards the service PMI numbers and factory order numbers due for release today.

The Australian dollar surged to a five-month high against the USD, as funds headed toward economies that are seen to be recovering the fastest from the coronavirus pandemic. The Aussie pared its gains to trade around $0.69 after data showed the Australian economy contracted as expected in the first quarter. The country’s treasurer said it is already in recession, but traders said sentiment has turned bullish because lockdown restrictions are easing and commodity prices are rising lowering expectations of further easing from the RBA or negative interest rates. Meanwhile, trade tensions between Australia and China are also to be watched closely.

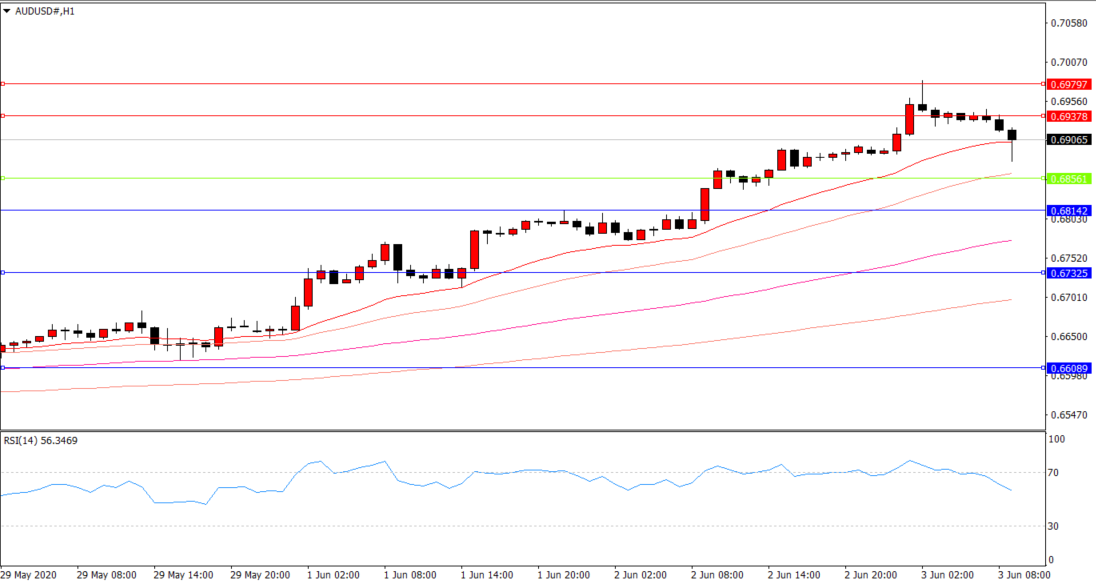

· On a technical perspective, the trend is bullish, with prices above the 20, 40, 100 and 200 EMAs.

· Prices have been finding strong support at the 20 EMA. This indicates that buying strength is present.

· Based on the pivot point analysis, prices are above the pivot levels. This signifies bullishness.

Resistance: R1: 0.69378, R2: 0.69797, R3: 0.71033

Support: S1: 0.68142, S2: 0.67325, S3: 0.66089